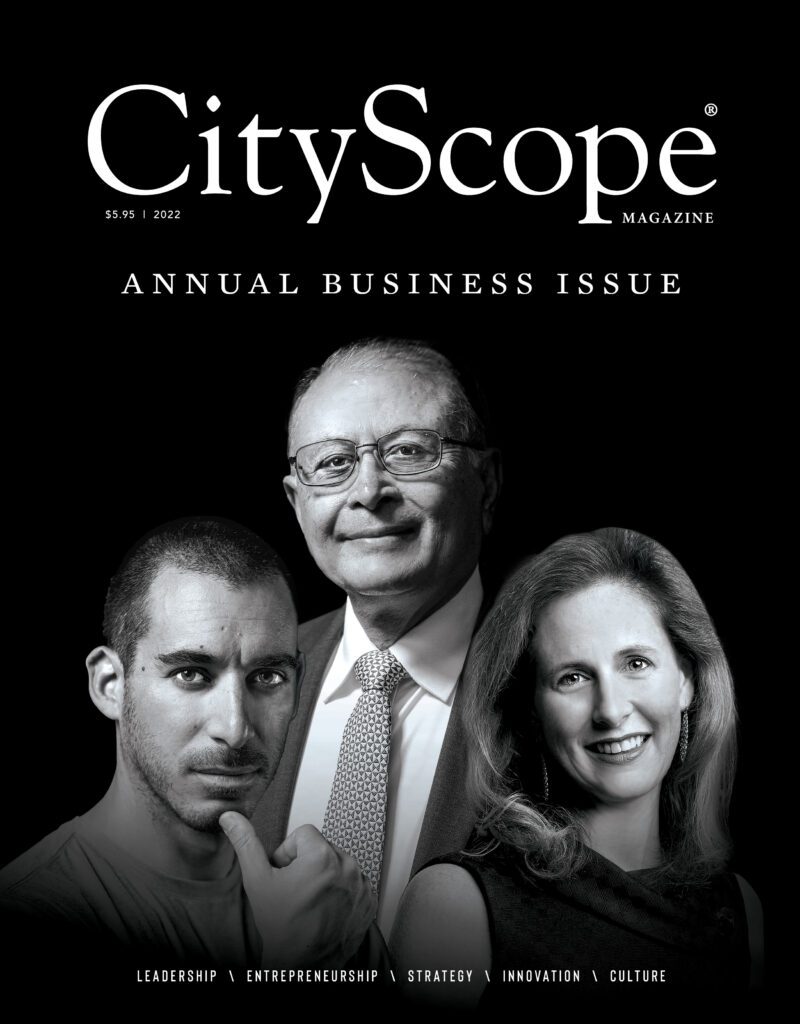

By Ray Ryan, CFA

This is the final essay in a three part series. In Part I, I explored how data has supplanted oil as the world’s most important commodity. A digital arms race has emerged among companies and economies to collect, analyze, and control as much data as possible. Unlike oil, data, the necessary fuel for technological enhancements, is supplied by those that use technology. This creates a seemingly virtuous circle between those that create technology and those that benefit from innovation. As newer technologies proliferate, the collected data feed future development. These trends raise important questions, however, with respect to ownership of information, regulation, privacy, and security.

Ray Ryan is the President of Patten and Patten, an investment management firm, and a Registered Investment Adviser in Chattanooga. Ray is a CFA Charter Holder, a member of the Advisory Board for UTC’s College of Business, and an Adjunct Professor of Finance at UTC. He is a graduate of Princeton University, where he had the privilege of taking a course taught by former Federal Reserve Chairman Ben Bernanke.

The key themes of Part II related to business models in the Information Economy. Because of the democratizing effect of the internet, consumers now have the ability to “pull” information. Pre-internet, a small group of information purveyors controlled most types of information that they, in turn, selectively “pushed out” to the public. Consumers today exert a great deal of influence – in effect, possessing the ability to demand specific types of information considered relevant and valuable. At the same time, information purveyors, such as social media networks, develop methods to increase user engagement. Once a consumer joins a network, information purveyors have large financial incentives to increase participation among their user bases. In order for this form of co-dependence to flourish, information purveyors must ensure that their content possesses integrity, and consumers must continue to maintain trust in their networks.

In this final essay, I present a synthesis of these topics as applied to investment management.

Markets are complex, adaptive systems that constantly evolve – similar to the human body. According to the Wall Street Journal, 80% of all stock trading now occurs on “autopilot.” This figure includes passive, “rules-based” investment vehicles such as index funds. As index funds attract a larger proportion of investor funds, the percentage of trading that is automated should continue to rise. Further, so-called Quant Funds, those that rely entirely on computer models known as algorithms, now account for nearly 30% of all stock trading. Could algorithms represent the next step in the evolutionary process of markets?

Perhaps.

An algorithm is a mathematically-based logic sequence, i.e., a set of rules, contained in computer programs to automate transactions. Its purpose is to take action. Algorithms analyze, at light speed, mountains of data. Processing volume and speed of analysis are the key factors to algorithmic success. Algorithms generally do not consider fundamental developments. They are not built to estimate intrinsic values of companies. They do not ponder extraneous considerations. Proponents of algorithms would argue that they also do not suffer from “paralysis through analysis.”

Indeed, if my success as an investment manager were determined solely by how much information I could process and how fast I could process it, I would probably need to find another profession. Yet, I do not compare what I do (i.e., invest) with algorithms (i.e., rules-based trading strategies). For long-term investors, there will always be value in taking a pause and exercising judgment when confronted with uncertainty.

Competition between humans and machines is nothing new. In the world of chess, for example, world champions have been matched against computers that use artificial intelligence for the past thirty years. These programs can process millions of potential moves each second. Unlike their human opponents, they do not tire or lose concentration.

Chess programs have consistently defeated human opponents. Their apparent advantage lies in the fact that, in chess, players are not allowed to skip a turn. In other words, each player is forced to “transact.” When compelled to move in certain situations, it is probable that one’s position could become weaker. A player is said to be “in zugzwang” when any possible move will worsen their position.

However, commentators, including those who have written some of these programs, have remarked that chess programs lack insight. They lack the ability to employ moves in a strategic manner. Instead, they compile probabilities associated with innumerable combinations of moves. The probabilities then inform the program on how to capture an opponent’s pieces with the goal of capturing as many pieces as possible. In many ways, chess programs are similar to the trading algorithms that have come to dominate market activity. Trading algorithms are constructed to “transact.” Unlike in chess, however, if an investor feels a certain trade could result “in zugzwang,” the investor can refrain from taking action.

Certain trend-following algorithms switch from “all-in” to “all-out” at the blink of an eye. These trend-following algorithms reinforce volatility and amplify market moves. In effect, markets now shift abruptly and more frequently because of fund flows directed by algorithms. It is as if everybody on a boat shifts from one side to the other at the same time. The impact of algorithms is, therefore, distortions that manifest in short, sharp market corrections.

The 2018 stock market was characterized by two volatility eruptions. The first occurred in February. The second occurred during December. Both were partly the result of temporary, technical imbalances. In December, everybody ran from one side of the boat to the other at the same time. Once the imbalance was resolved, the boat quickly returned to stability, and volatility subsided.

In the early days of ESPN, broadcasts were limited to Australian rules football and monster truck drives. ESPN added mainstream sports to its repertoire, and over time, the cable network transformed sports broadcasting. In similar fashion, CNBC transformed the stock market into a spectator sport. CNBC displays real-time prices of market indices and many tradable assets. Viewership tends to rise during periods of market volatility. CNBC has responded by incessantly highlighting whether the stock market has entered a “correction” or a “bear market.” To financial journalists, the magnitude of a downward move is what matters as they arbitrarily define a bear market as a decline of more than 20%. Everything else, according to CNBC, is a correction.

The magnitude of a market decline is secondary to the causes of the decline. Corrections differ from bear markets with respect to underlying fundamentals. Bear markets are the result of deteriorating economic fundamentals, whereas during a correction, fundamentals remain intact.

Bear markets form like hurricanes in the middle of the ocean. They move slowly and gather strength as they approach land. Today, technology assists weather services in assigning the probability of damage and location of impact. Hurricanes usually afford residents time to take precautions, to prepare, to evacuate. Similarly, there is usually time to adjust portfolios prior to the onset of a bear market.

As an example, Hurricane Katrina’s strength was expected. The far more devastating aspect of Katrina, however, was the associated flooding as the storm overwhelmed the outdated infrastructure of levees that had protected New Orleans for decades. The infrastructure of New Orleans needed to be rebuilt.

As early as 2005, there was evidence that the U.S. housing market was in a bubble, but the Great Financial Crisis would not begin for three years. The markets provided time for investors to evacuate – i.e., to reduce exposure to the banking and housing sectors. Like Katrina, it was the unexpected collateral damage that proved far worse – e.g., collapses of English banks and German insurance companies. The severity of the Great Financial Crisis was the direct result of the collapse of the global financial infrastructure. The system needed to be rebuilt.

Corrections, on the other hand, are like earthquakes. They arrive without warning. They tend to be sharp, yet brief. As any longtime California resident can attest, they are also frequent. Following a tremor, one assesses the damage while bracing for aftershocks. In most earthquakes, the damage proves limited. Likewise, the damage to portfolios from most stock market corrections proves limited and temporary. Even the Crash of 1987, which can be compared with the massive San Francisco earthquake of 1989, did not lead to either a bear market or a recession.

The most damaging aspect of stock market corrections is a loss of investor confidence. With lost confidence, a correction can grow into a bear market that, in turn, can lead to a recession. Because of the increasing presence of technology in the markets, particularly algorithms and other automated, rules-based approaches that limit or eliminate human judgment, investors should expect more frequent corrections that result from temporary, technical imbalances. Yet, they should recognize, like residents of California, the nature of these disturbances and focus on the fundamentals. In most cases, the damage should prove limited and temporary.

However, commentators, including those who have written some of these programs, have remarked that chess programs lack insight. They lack the ability to employ moves in a strategic manner. Instead, they compile probabilities associated with innumerable combinations of moves. The probabilities then inform the program on how to capture an opponent’s pieces with the goal of capturing as many pieces as possible. In many ways, chess programs are similar to the trading algorithms that have come to dominate market activity. Trading algorithms are constructed to “transact.” Unlike in chess, however, if an investor feels a certain trade could result “in zugzwang,” the investor can refrain from taking action.

Certain trend-following algorithms switch from “all-in” to “all-out” at the blink of an eye. These trend-following algorithms reinforce volatility and amplify market moves. In effect, markets now shift abruptly and more frequently because of fund flows directed by algorithms. It is as if everybody on a boat shifts from one side to the other at the same time. The impact of algorithms is, therefore, distortions that manifest in short, sharp market corrections.

The 2018 stock market was characterized by two volatility eruptions. The first occurred in February. The second occurred during December. Both were partly the result of temporary, technical imbalances. In December, everybody ran from one side of the boat to the other at the same time. Once the imbalance was resolved, the boat quickly returned to stability, and volatility subsided.

In the early days of ESPN, broadcasts were limited to Australian rules football and monster truck drives. ESPN added mainstream sports to its repertoire, and over time, the cable network transformed sports broadcasting. In similar fashion, CNBC transformed the stock market into a spectator sport. CNBC displays real-time prices of market indices and many tradable assets. Viewership tends to rise during periods of market volatility. CNBC has responded by incessantly highlighting whether the stock market has entered a “correction” or a “bear market.” To financial journalists, the magnitude of a downward move is what matters as they arbitrarily define a bear market as a decline of more than 20%. Everything else, according to CNBC, is a correction.

The magnitude of a market decline is secondary to the causes of the decline. Corrections differ from bear markets with respect to underlying fundamentals. Bear markets are the result of deteriorating economic fundamentals, whereas during a correction, fundamentals remain intact.

Bear markets form like hurricanes in the middle of the ocean. They move slowly and gather strength as they approach land. Today, technology assists weather services in assigning the probability of damage and location of impact. Hurricanes usually afford residents time to take precautions, to prepare, to evacuate. Similarly, there is usually time to adjust portfolios prior to the onset of a bear market.

As an example, Hurricane Katrina’s strength was expected. The far more devastating aspect of Katrina, however, was the associated flooding as the storm overwhelmed the outdated infrastructure of levees that had protected New Orleans for decades. The infrastructure of New Orleans needed to be rebuilt.

As early as 2005, there was evidence that the U.S. housing market was in a bubble, but the Great Financial Crisis would not begin for three years. The markets provided time for investors to evacuate – i.e., to reduce exposure to the banking and housing sectors. Like Katrina, it was the unexpected collateral damage that proved far worse – e.g., collapses of English banks and German insurance companies. The severity of the Great Financial Crisis was the direct result of the collapse of the global financial infrastructure. The system needed to be rebuilt.

Certain trend-following algorithms switch from “all-in” to “all-out” at the blink of an eye. These algorithms reinforce volatility and amplify market moves. In effect, markets now shift abruptly and more frequently because of fund flows directed by algorithms.

Corrections, on the other hand, are like earthquakes. They arrive without warning. They tend to be sharp, yet brief. As any longtime California resident can attest, they are also frequent. Following a tremor, one assesses the damage while bracing for aftershocks. In most earthquakes, the damage proves limited. Likewise, the damage to portfolios from most stock market corrections proves limited and temporary. Even the Crash of 1987, which can be compared with the massive San Francisco earthquake of 1989, did not lead to either a bear market or a recession.

The most damaging aspect of stock market corrections is a loss of investor confidence. With lost confidence, a correction can grow into a bear market that, in turn, can lead to a recession. Because of the increasing presence of technology in the markets, particularly algorithms and other automated, rules-based approaches that limit or eliminate human judgment, investors should expect more frequent corrections that result from temporary, technical imbalances. Yet, they should recognize, like residents of California, the nature of these disturbances and focus on the fundamentals. In most cases, the damage should prove limited and temporary.