Investing When a Correction Seems Imminent

Defensive Investors Can Still Take Advantage of the Bull Market

By Andy Burnett, AAMS®

Although often conflated, there is a difference between investor sentiments and economic fundamentals. If a financial market shows indicators of continued growth, what might actually stop that from happening?

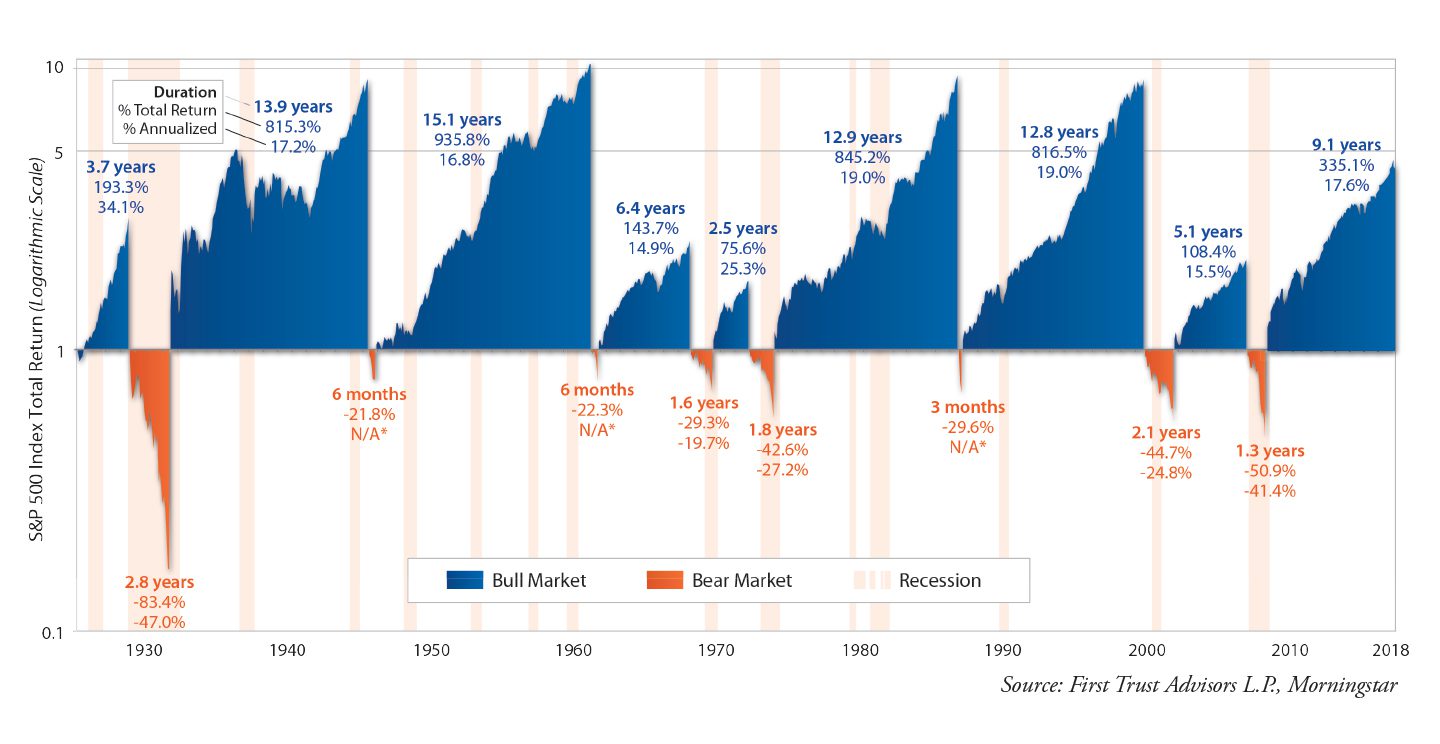

The US stock market has been in a bull market cycle for around the last 9 years,

during which a perfectly timed investor who bought in on March 9th, 2009, would have seen a total increase in wealth of 335.1% at an annualized rate of around 17.6%.

Coincidentally, the historical average “age” of a bull market is also around 9 years, but investing under the assumption that stocks are due for a bear market can be a trap. If the economy stays healthy, there’s reason to believe the stock market will also stay healthy.

The Importance of Interest Rates to Market Health

The recent and anticipated increases in the federal funds rate (the rate the Fed targets for inter-bank lending) may act as a drag on stocks, because higher interest rates mean higher corporate borrowing costs. Borrowing for all parties, from corporations to citizens, is becoming more expensive, and it is possible the higher interest cost could drag down corporate earnings and diminish spending money in the pockets of individuals. If a stock price is valued based on continued low cost borrowing, that stock will become too expensive and will eventually adjust downward to a more appropriate price. Does this mean higher interest rates will kill the bull? Not necessarily.

The Rate Spread

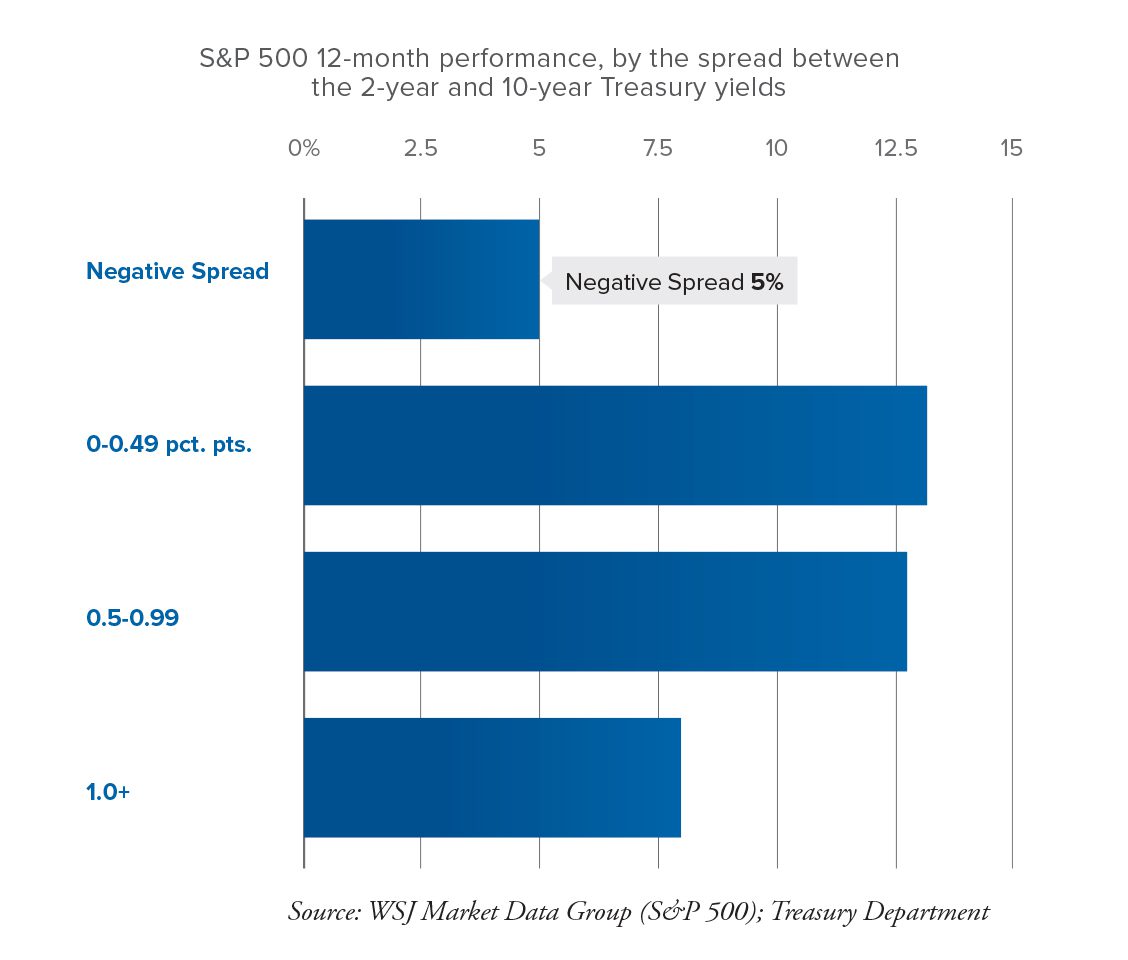

Short-term rates on US Treasuries have moved upward as the Fed has raised the federal funds rate, but longer-term Treasury rates, which are currently higher than short-term rates, have not risen at the same pace. Since longer-term rates have not risen as rapidly as their shorter-term counterparts, the rate spread between short and long-term rates has begun to narrow (as of 05/07/2018). The difference in rates between short-term 2yr Treasuries and longer-term 10yr Treasuries, or the “2-10 spread,” has “flattened” to around 0.50% (50bps) from its high of around 1.30% (130bps) in 2017. If this trend continues and the curve inverts (meaning long-term rates become lower than short-term rates), many investors will take it as a sign of a coming recession. Inversion of the 2-10 spread has reliably preceded every recession since 1975.

However, the same data shows that stock markets have historically performed best when the 2-10 spread was under 1.00% (100bps) but greater than zero, so if history repeats itself, continuing the 2-10 spread suggests the bull market still has some life left.

Considering the future using CAPE and NTM P/E

The Shiller Cyclically Adjusted Price-Earnings Ratio (CAPE) is a widely-followed measurement of S&P 500 earnings per share (EPS) over a 10-year rolling period used to determine whether a market is over- or under-valued. At face value, CAPE currently suggests the US market is overvalued with a ratio of somewhere around 32, nearly double the historical average of 16.8 since 1900.4 However, CAPE doesn’t factor in changes in accounting standards, tax regimes, or demographics, all of which can have a significant impact on valuation. If adjustments are made to accommodate for some of these variables, such as adjusting S&P earnings for AIG’s unlikely collapse in 2008, the ratio looks more favorable.5 Also, dividing current stock prices by forecasted corporate earnings creates the next twelve months price-earnings ratio (NTM P/E), another useful measurement of market valuation. The NTM P/E, which assumes prices remain stable and forecasts are met, is currently hovering somewhere around 16.4, which is more in line with the historical average (as of 05/07/2018).6

Building a Defensive Portfolio

Regardless of whether the rally continues, investing defensively today is a practical way to prevent “portfolio shock” in nearly any market environment. Here are some ideas on how to mitigate risk.

1. Invest Internationally

The combination of climbing interest rates and high stock prices suggests the US market faces some headwind in 2018 and 2019. Outside the US, valuations look more attractive, and throughout most developed international markets, interest rates remain low. Despite strong growth in 2017, international stocks still have room to run, and investors should consider allocating more of their portfolio abroad. In contrast to the US, the Morgan Stanley Capital International – Europe, Australasia, and Far East Index (MSCI EAFE), often used as a proxy for international developed equity markets, currently has a NTM P/E valuation of around 14.1.7

2. Shorten bond portfolio duration

There is an inverse relationship between bond yields and price. With more interest rate increases expected, now is a good time to shorten overall bond portfolio duration by selling long-term bonds and buying shorter-term bonds, since shorter duration bonds are better equipped to handle interest rate increases. Floating rate bonds can also be an attractive option in a rising rate environment, but investors should be wary of increased credit risk with floating rate debt. For this reason, a lower allocation to floating rates is generally recommended.

3. Consider Alternative Investments and Real Estate

A defensive portfolio should include investments with a low correlation to stock market returns.Investments that could qualify include commodities (such as oil, soybeans, wheat) and precious metals (gold, silver, platinum) – both of which can be accessed easily through mutual funds and exchange traded funds – and real estate, which can be directly held (i.e. owning an investment property) or accessed through publicly or privately traded Real Estate Investment Trusts (REITs). Be aware that real estate tends to be interest rate sensitive, which can make investing difficult in the current rising rate environment. These asset classes tend to move independently of the stock market and can be a good way of hedging equity losses.

Summary

Is the bull market dead in 2018? Probably not, even though the market may see tapered growth in 2019. Regardless of the interest rate environment or yield spread, set an investing time horizon and build your portfolio around it. It is acceptable to invest for growth – where “growth” means a portfolio invested 80% or more in stocks – if the time horizon for needing a more balanced allocation of securities is at least 10 years away. Once the time for growth investing has passed, you may want to begin reducing your overall portfolio risk by investing more defensively in bonds and alternatives. A balanced allocation of 60% stocks / 35% bonds / 5% alternatives may make sense for an investor five years away from beginning portfolio withdrawals. Remember that good economic news today does not necessarily translate into good stock market returns tomorrow. Stock prices move in anticipation of economic news, and if interest rates rise too quickly with corporate earnings failing to keep up, expect stock market prices to correct downward. Thoughtfulness and discipline are critical to any viable portfolio strategy, and a patient investor is a successful investor. Keep calm and invest on!