By George Christian

Come up with the idea.

There are many ways to identify new business opportunities. Among them are 1) identifying a need in a market that is not being completely satisfied by current providers of a good or service, 2) identifying a product or service that is not available at all and will serve an unmet need, 3) identifying a product or service that is not available in your geography, 4) introducing a tried and tested product or service, for example, one established by a franchise operation.

Conduct a personal evaluation.

Before you commit yourself to starting a new business, experts emphasize that you should conduct a personal evaluation. Ask yourself: Why do I want to start a business? Is it money, freedom, creativity, or some other reason? What are your strengths and weaknesses? What knowledge do you have of the industry? Does the new business match well with your skills and not just what you would like to do? How much capital do you have, and how much are you willing to risk? Answering these questions and asking many more about yourself and the business that you may pursue will provide a fresh overall perspective on whether it’s a good match for you.

Analyze your industry.

Once you have decided that a potential new business would be a good fit for you, then you need to evaluate your idea by analyzing the industry and your idea and assessing how much money will be needed to start and then sustain the business until it is fully operational. Research can be conducted through online searches, interviews, industry publications, suppliers, brokers, government sources, and more. In evaluating your market and the prospects for your new business, you need to answer several questions. Among many key areas to understand, important questions are: How big is the market? Is it new or growing or shrinking? Who is your target market? Does this market need or want your product or service and how badly? What do competitors offer? Are their clients satisfied? How easy or hard will it be to gain new customers or clients? What is the method of distribution and are there alternatives that offer a competitive advantage? Are there regulations or any barriers to enter the market? How much money will be needed over what period of time to attract new customers or clients? How much money will you need to start the new business and sustain it during the early stages of growth to profitability? How long will it take for you to get your product or service to market? Can you gain market share great enough to prosper or offer an alternative product or service that consumers or clients will select? How quickly is the industry changing and will your product or service remain relevant? How will your competition respond and how will you respond to gain and keep clients? How likely will you be able to attract investors and raise needed capital?

Validate your concept.

Before you do anything more, it is important that you conduct market research to determine if your product or service does offer a unique point of difference that will provide for a long-term, sustainable, and profitable business. This can be done through a number of different research methods to test the concept or idea’s appeal among consumers or clients and gather data to project the potential size for your new business. It is important to recognize that, first and foremost, the business has to create economic value and not a job for yourself.

Form your legal business.

A key part of forming your new business includes understanding the different types of business organizations and the pros and cons associated with each, along with any federal, state, city, and county regulations. Select an attorney to assist with this process and if nothing seems to prohibit you from competing freely and in a manner that you believe is best for your business, then establish and register your business entity. Recognize that it is important to establish the business in a manner that separates your personal assets from the business. For example, an LLC is a better option than a sole proprietorship.

Establish a business plan.

If the assessments noted above still support pursuing your new business, then you need to establish a business plan and formalize your intentions. It should define your vision for your business, what your product or service offers, and how it will outperform competitive offerings. At the very least it should outline what your goals are for the first year followed by the subsequent two years (a three-year plan) and what will it take to break even. For each time frame, the plan needs to include your strategies for how goals will be reached along with specific activities to be executed by specific dates. Additionally, your plan needs to provide projected profit and loss, budgets, cash flow, and balance sheet statements for each time frame.

Choose your growth and exit plan.

There are three very different strategies for your business. One is described as being a business builder, or creating a lifestyle biz, where you develop a business, stay in control, and grow with the business. Another is venture builder – where you look to scale up a business fast, attract a management team to run the company, and maintain a profitable and often influential share of the company. The third is venture flipper – one who develops a product or business quickly and exits quickly for a potential profit. All three require completely different strategies for development, financing, and exiting the business.

Pitch your business to investors.

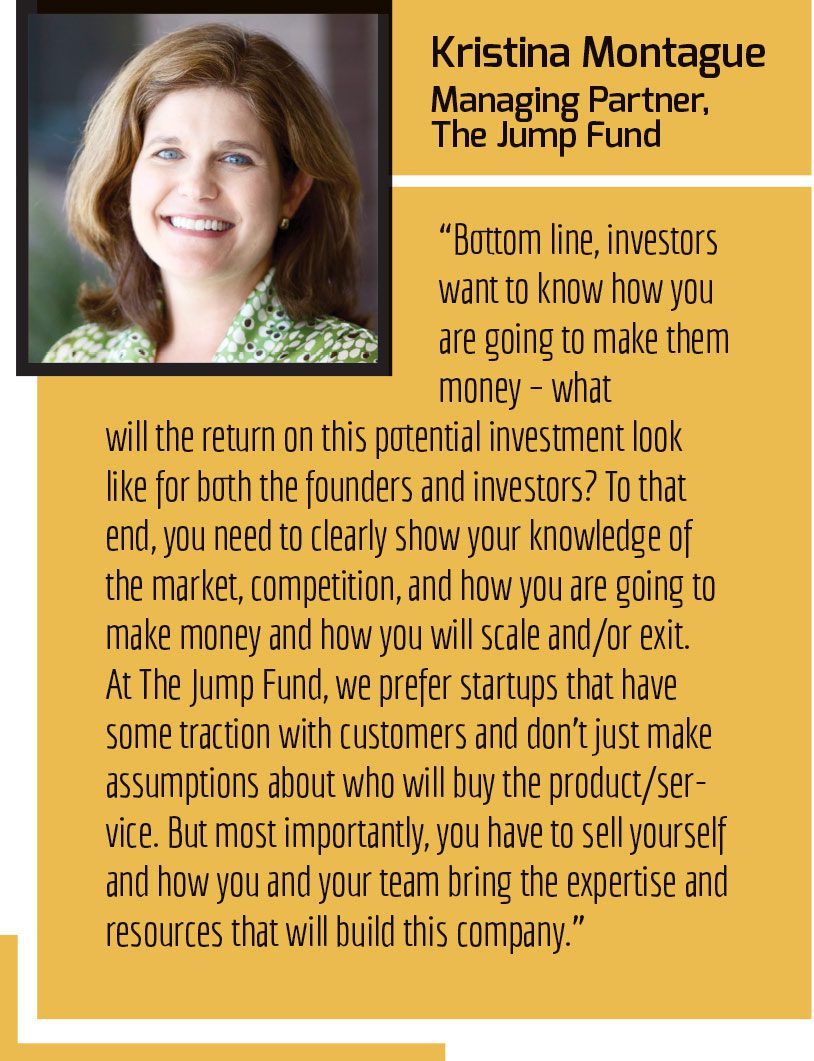

The lifeline for startup businesses is the capital needed to enter a market and then grow operations until the business generates profit great enough to support daily operations and shareholders. To attract investors, new business owners need to be prepared to address all aspects of the business. Among the most important are the financial projections for the business over the next one to three years and the assumptions behind these numbers – which for the most part are those included in the strategic plan. Of great importance is the market size, the uniqueness of your product or service, sustainable competitive advantages, the level at which your product or service can outperform alternative products, key customers and what they buy and how to reach them, the potential for fast growth, and the rate of return and timing for investors.

Additionally, investors need to be convinced that as a business owner, you and your management team have the experience, commitment, and passion to build a business from the ground up. Angel investors, in particular, need to be convinced that there will be good chemistry between the leader of the business and the investment group.

Prior to a meeting with an investment group, it is important to be prepared to answer investor questions. Know what your capital needs are and when it is needed, what share of the company you are willing to offer to investors, and what each investment group looks for in companies chosen to invest in. It is also important to realize that investors are influenced more by their belief in people than in an idea.

Educate yourself on equity financing.

In addition to debt financing offered by banks and other creditors, three common outside sources of capital for private companies are angel investors, venture capital firms, and private equity firms, all of which fall under the umbrella term of “equity financing.” The three are similar in their strategy – they each offer capital in return for equity, or ownership, in a company – but they differ significantly in their goals and preferences.

Angel Investors.

Angel investors usually focus on seed and early-stage companies. They are often wealthy individuals who provide one-off early-stage capital for startups in exchange for a stake in the company. In many cases they are seasoned entrepreneurs interested in “paying it forward’’ to the next generation of businesses. Often, angel investors work together to pool funds into a single investment fund. Angel investors generally have a long-term view on returns and are often closely involved in their portfolio companies, playing a crucial mentoring role to help grassroots enterprises become eligible for larger investments from VC firms. Convertible debt is a popular method for financing a startup by angel investors. Under this agreement a startup receives financing in the form of debt with the agreement that it will pay interest for a period of time until the debt converts to equity under predefined terms – generally with a significant discount to the equity valuation at the time of conversion. The term of the convertible debt is normally six months to two years and is used when it is too early to place a value on a company.

Venture Capital Firms.

VC firms normally focus on early to mid-expansion companies. VCs raise money from shareholders to open funds, and then dependent on the profile of each fund, invest in different companies. Typically, VCs invest in businesses that have proprietary ideas and are led by proven entrepreneurs. Accountable to their investors, VC firms are usually expected to generate returns of 20 to 30 percent.

Private Equity Investments Firms.

Private equity investment firms normally focus on mid-expansion to mature companies. Unlike VC funds that buy equity in startups, PE firms target more mature companies, either to help company management accelerate growth, or to assist with restructuring in order to make them more profitable. PE firms won’t invest in as many companies as VCs, but their investments are of a much larger value.

Seed Capital.

Funding rounds begin with “seed capital,” and normally are followed by series A, B, and then C funding. The differences between each type of funding is primarily related to the maturity level of the business, the type of investors involved, and the purpose of the capital. As noted above, seed capital is often provided by angel investors or early-stage venture capital firms and is used to support the development of a new product or service into a profitable operating business. Often seed funding supports the initial market research and development work for the company. Additionally, the money serves to employ a team to do the work. Capital raised in the seed phase is normally $500,000 to $2 million. On average, Angel investors receive about a 15 percent post-seed equity position in startup companies.

Series A: After the business has demonstrated a track record of success, Series A funding is used to optimize a product or service and scale up operations to ensure profitable long-term growth. Typically, Series A rounds raise approximately $2 million to $15 million. The investors involved in the Series A round come from more traditional venture capital firms. In exchange for financing, the VCs receive an estimated 10 to 30 percent ownership stake in the startup.

Series B: This funding is to support taking a new business to the next level where it can maximize market share through, among other initiatives, increased marketing and hiring executive level personnel. In Series B, venture capitalists have more of a vision around what the market size looks like, and how much market share the business can achieve. The level of capital associated with Series B funding is roughly $7 to $10 million and involves VC firms that specialize in later-stage investing. In exchange for this round of funding, Series B investors receive, on average, a 33 percent equity position in the startup, resulting in the proportionate dilution to seed and Series A ownership percentages.

Series C: This type of funding is generally raised when a business and investors believe that the business can grow to a significantly greater level than its current position. This can be driven by, among others, the potential to gain much greater market share, the expansion into new markets including international markets, or acquisitions. In Series C, the level of investment is greater, but the risk to investment groups is perceived to be lower and the potential for excellent returns higher. The level of capital associated with Series C funding ranges from $10 million to several $100 million. In addition to VC firms, hedge funds, investment banks, private equity firms, and big secondary market groups participate. This is often the last stage in a company’s growth cycle before an Initial Public Offer (IPO).

Mezzanine Financing (when needed in a pinch).

This type of funding is a hybrid of debt and equity financing in that the debt lender has the right to convert to an ownership or equity interest if the loan is not paid back. It is treated as equity on the business balance sheet. It is most often used by companies that are performing well and need to fund growth (such as an acquisition, new product line, new distribution channel, or plant expansion), without providing additional equity positions in the company. Mezzanine debt is generally provided to a business quickly and with little due diligence on the part of the lender and with little or no collateral from the business. With this type of financing, the lender seeks a return in the 20 to 30 percent range. Generally, pension funds, hedge funds, leveraged public funds, and insurance companies, as well as banks participate in mezzanine financing.

Hold, buy, or sell.

From the outset, successful entrepreneurs work to achieve economic value for themselves and investors. As a matter of ongoing planning, business owners must evaluate their current and future strengths, weaknesses, opportunities, and threats (SWOT). With this knowledge, the company must plan for the length of time in which it will be held and when it may be sold. When holding, initiatives to achieve organic growth and acquisitions must be made to advance the value of the firm to all involved. Strategies and plans for positioning the company for sale, selling the company to new investors, and harvesting the company (maximizing returns for current investors with or in advance of new ownership) need to be established. As economic factors change and markets adjust, the entrepreneur, in his or her quest to maximize financial returns, will hold, buy, or sell and the economic ecosystem of the entrepreneur continues.