Financial Advisor Andy Burnett has been with Round Table Advisors of Raymond James since January 2016. He holds Series 7 and 66 licenses, as well as the AAMS® designation.

Financial Advisor Andy Burnett has been with Round Table Advisors of Raymond James since January 2016. He holds Series 7 and 66 licenses, as well as the AAMS® designation.

Investing in Times of Global Uneasiness

Be Informed, Not Impulsive

by • Andy Burnett, AAMS®

With economic globalization and automation continuing to displace workers, tensions between the West and North Korea rising, and a populist wave spreading across the U.S. and Europe, how does one invest in an environment so fraught with turmoil? The answer may surprise you.

We’re all globalized now

Despite calls for increased domestic production, the movement to globalize and automate continues, with international sales representing approximately 44% of revenue generated by S&P 500 companies in 2016.1 Rather than trying to fight the economic shift, investors should be aware of their exposure to the global economy through U.S. equities and accommodate for it in their asset allocation models.

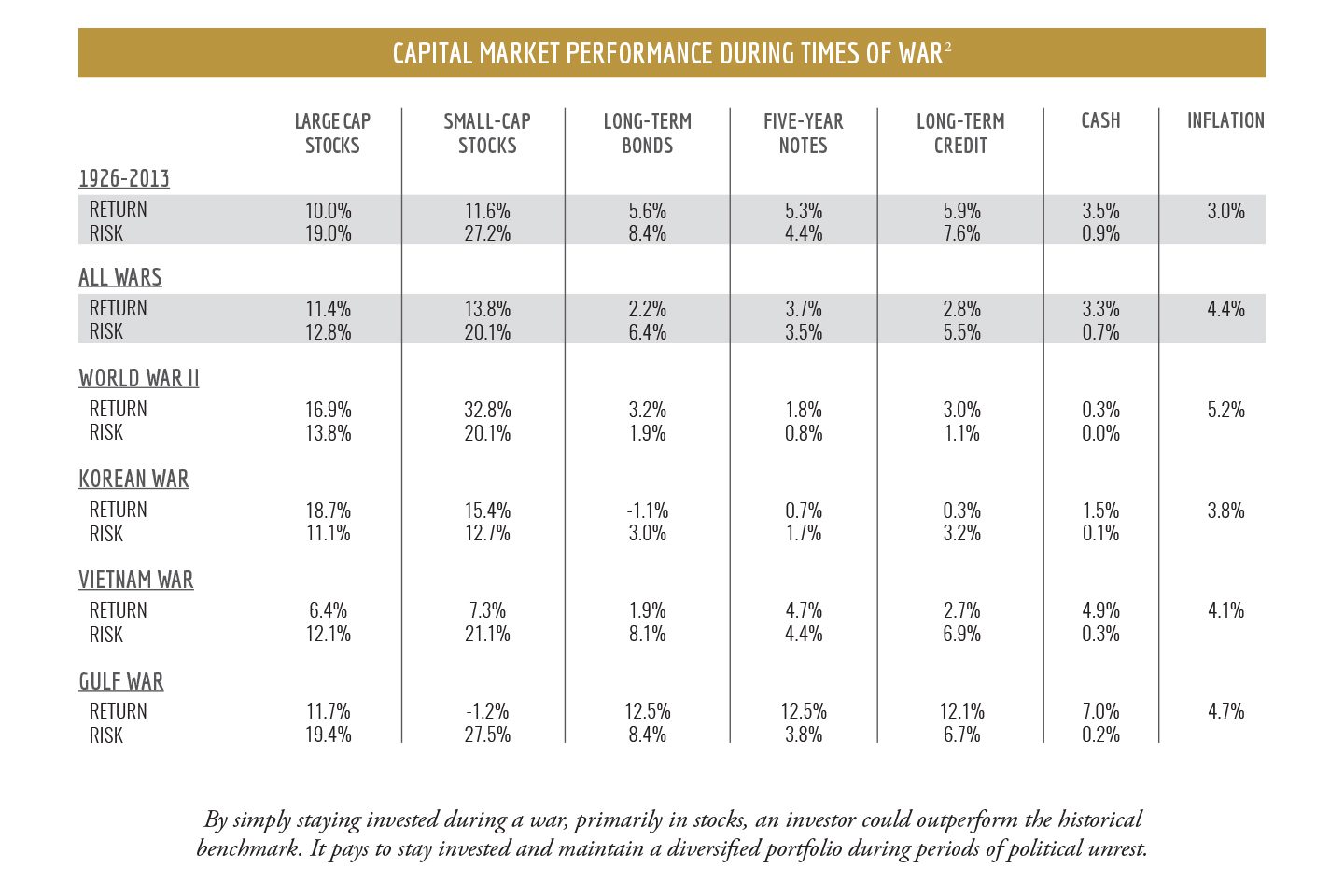

How is “the market” affected by war?

Historically speaking, the equity market is actually less volatile and outperforms during wartime, while bonds have underperformed.2 Below is a performance analysis of asset classes during recent wars, with the most recent Gulf War left out since the U.S. went through a major economic boom and bust unrelated to the war during its duration (2007-2008 financial crisis).

Is a market pullback imminent?

Since the U.K. voted to leave the E.U., and Donald Trump was elected president, much has been discussed about the so-called “populist wave” spreading across the western world. This may be a sign of increased political fragmentation,3 but the aftermath of these events, in my opinion, has done little to affect financial markets, aside from some initial volatility in the wake of the votes. Stock prices typically rise in anticipation of events that can increase business earnings, and increased earnings can be triggered by enactment of laws that lower taxes (which decrease tax payments), or reduce regulations (which lower business costs). If the Trump administration is unable to make good on its promises to do both these things, the market could “correct” negatively, a glimpse of which we may have seen on May 17. Obsessing over whether a correction is near isn’t the point though, as investors should be thinking in terms of time horizons. Current income needs (i.e. cash in the checking account) in the next 1-3 years should be invested in liquid cash and alternatives (e.g. CDs, T-Bills, and money markets), funds needed within 4-7 years in a balanced portfolio, and funds needed 8+ years from today invested for growth.

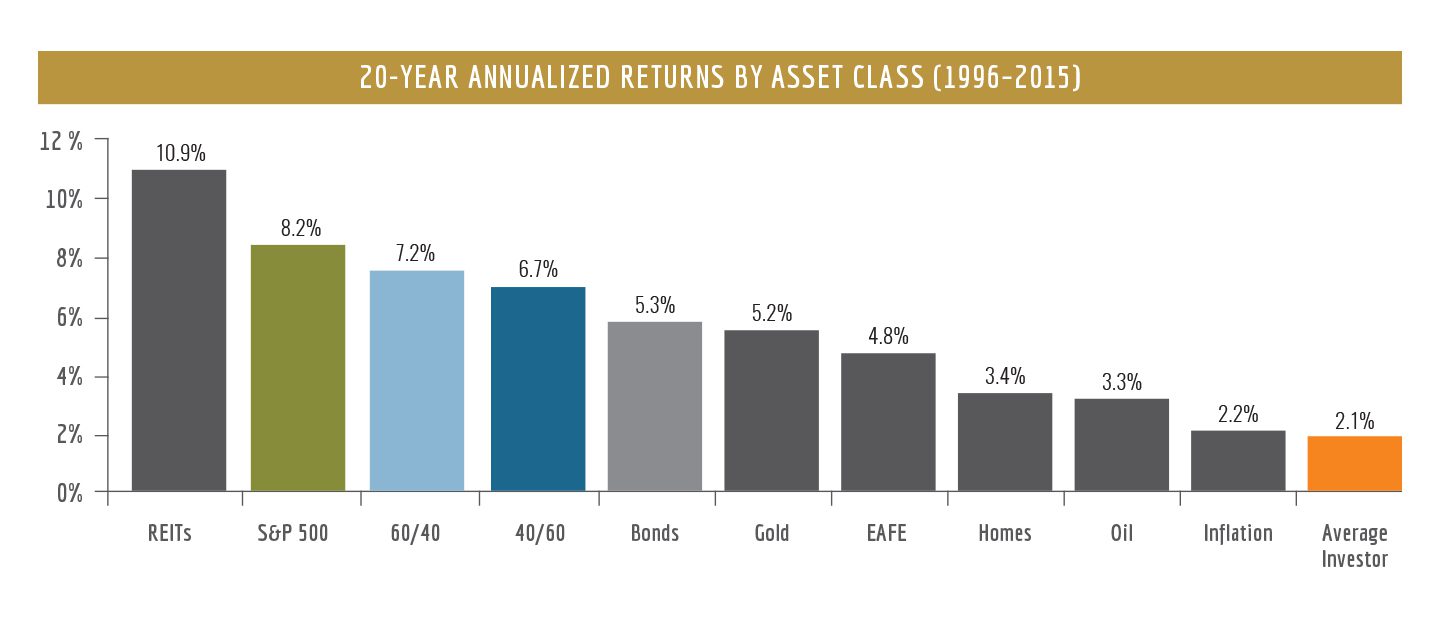

Source: J.P. Morgan Asset Management; (Top) Barclays, FactSet, Standard & Poor’s; (Bottom) Dalbar Inc.

Indexes used are as follows: REITS: NAREIT Equity REIT Index, EAFE: MSCI EAFE, Oil: WTI Index, Bonds: Barclays U.S. Aggregate Index, Homes: median sale price of existing single-family homes, Gold: USD/troy oz, Inflation: CPI. 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high quality U.S. fixed income, represented by the Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/15 to match Dalbar’s most recent analysis.

Guide to the Markets – U.S. Data are as of December 31, 2016.

The fallacy of market timing

Here’s an excerpt from the transcript of Becky Quick’s interview with Warren Buffet on CNBC’s “Squawk Box” from February 27, 2017, regarding timing a market pullback after the Dow passed 20,000 points:4

“…if there’s a game it’s very good to be in for the rest of your life, the idea to stay out of it because you think you know when to enter it – is a terrible mistake. I don’t know anybody that can time markets over the years. A lot of people thought they can. But, if you were buying a farm and you decided that farms were gonna be worth more money 10, or 20, or 30 years from now and that would be a productive asset, go out and buy it…”

Investors often stay uninvested during bull markets, hoping to identify the peak (top) and invest at the trough (bottom). In reality, the long-term expense of staying out of the market almost always outweighs the potential for avoiding losses. Financial services firm JP Morgan summarized from a famous Dalbar study titled “Quantitative Analysis of Investor Behavior” that the average investor achieved only a 2.1% annualized return over the last 20 years, due in part to badly timed investment decisions, as compared to more than 7% in a 60%/40% stock/bond portfolio.5

Have investing discipline

Legendary investor Benjamin Graham once said, “If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.” A disciplined investor should never get too caught up in the buying frenzy of a hot stock or IPO if thorough analysis of company fundamentals suggest a poor investment. The same level of indifference should be applied when selling stocks as well. Investing on a consistent basis, utilizing a proven investment strategy like dollar cost averaging (investing equal amounts monthly or over a fixed period of time), will help manage investment timing and keep an investor committed to a strategy.

Putting it together

There are many ways to approach investing, but one that’s focused on consistency and deliberate time horizon planning remains a reliable way to achieve positive returns over a lifetime, regardless of political unrest, disruptive technology, and changes in the global economy. While the tools have improved, the principles of successful investing remain largely unchanged. Discipline, patience, and analysis are keys to investing success, all of which a good financial advisor should integrate into an investment policy statement within a financial plan. Change is inevitable in the years ahead, but stay invested with a plan and the future will be bright!

1. Indices, S&P Dow Jones. “S&P 500 Foreign Sales at 44.3%, Lowest Level Since 2006.” PR Newswire: News Distribution, Targeting and Monitoring. S&P Dow Jones Indices, 27 July 2016. Web. 08 May 2017. <http://www.prnewswire.com/news-releases/sp-500-foreign-sales-at-443-lowest-level-since-2006-300304662.html>.

2. Armbruster, Mark. “What Happens to the Market If America Goes to War?” CFA Institute Enterprising Investor. CFA Institute, 16 Dec. 2015. Web. 08 May 2017. <https://blogs.cfainstitute.org/investor/2013/09/25/u-s-capital-market-returns-during-periods-of-war/>.

3. Friedman, Uri. “What If the ‘Populist Wave’ Is Just Political Fragmentation?” The Atlantic. Atlantic Media Company, 17 Mar. 2017. Web. 08 May 2017. <https://www.theatlantic.com/international/archive/2017/03/dutch-election-wilders-populism/519813/>.

4. Staff, CNBC.com. “Here Is the Full Transcript of Billionaire Investor Warren Buffett’s Interview with CNBC.” CNBC. CNBC, 28 Feb. 2017. Web. 08 May 2017. <http://www.cnbc.com/2017/02/27/billionaire-investor-warren-buffett-speaks-with-cnbcs-becky-quick-on-squawk-box.html>.

5. Morgan, JP. “Principles for Successful Long-Term Investing.” https://www.jpmorgan.com. JP Morgan, Jan. 2017. Web. 08 May 2017.

Article provided by Andy Burnett, Financial Advisor at Raymond James & Associates, Inc., Member New York Stock Exchange/SIPC 1200 Premier Drive, Suite 100, Chattanooga, TN 37421. He may be reached at 423-322-5445. The information contained herein has been obtained from sources considered reliable, but we do not guarantee that the foregoing material is accurate or complete. This information is not a complete summary or statement of all available data necessary for making a decision and does not constitute a recommendation.

Dollar cost averaging does not assure a profit and does not protect against loss. It involves continuous investment regardless of fluctuating price levels of such securities. Investors should consider their financial ability to continue purchases through periods of low price levels.

Diversification and asset allocation do not ensure a profit or protect against a loss. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.